AI chip war heats up as Nvidia targets smart farm machinery

US company partners with Yamaha Motor as battle with Intel grows beyond car chips

TOKYO — Nvidia is joining forces with Japan’s Yamaha Motor to create smart machinery for agriculture and other fields, firing a shot in the intensifying battle for supremacy in chips designed for artificial intelligence.

The American chip design and graphics card company is scrabbling with compatriot Intel and rising Chinese competitors to supply chips for rapidly processing massive amounts of image and other data. The war is spilling over into new frontiers from existing ones like automated driving and data centers.

The Yamaha team-up is geared to build unmanned agricultural vehicles for such tasks as picking and transporting fruits and vegetables, with plans for commercialization in 2020. The duo will also work to advance industrial drones, which have uses in farming.

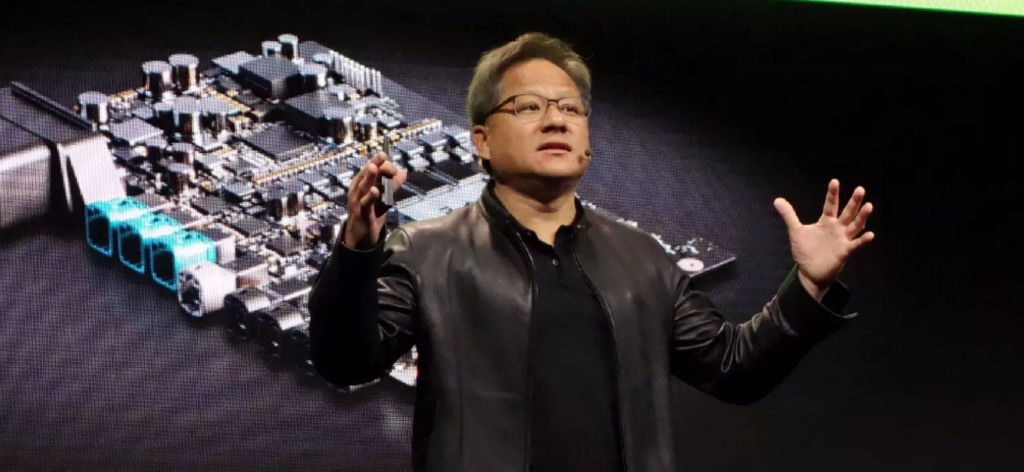

“Agriculture is incredibly difficult because every plant and every fruit and every vegetable looks different,” Nvidia founder and CEO Jensen Huang told Nikkei and other outlets here Thursday. “It is impossible for a human to write software to recognize every broccoli, every lettuce, every cabbage; it’s not possible.”

But deep learning — a technique where AIs train themselves — can “teach these intelligent machines how to recognize all of the world’s complicated, diverse types of plants, and vegetables, and fruit, and disease, and insects,” he said. “It’s now possible for us to teach an AI these things.”

Automated cars have been mainly responsible for the expansion of the AI chip market so far, but labor-starved fields like agriculture, machine tools and construction equipment are becoming new battlegrounds. By 2020, the market for automated-car chips will expand 30% from 2017 levels to $50 billion, while the market for industrial device chips will log 30% growth to $62.3 billion, according to U.K. research firm IHS Markit.

Everyone is targeting the industrial device market, said Akira Minamikawa of IHS. Competition there is becoming as fierce as in chips for cars, he said.

The ability of Nvidia-designed graphics processors to efficiently plow through large volumes of data makes them well-suited for deep learning. Nvidia products have come to serve as the brains of machine tools and other devices. The company’s other Japanese partners include Komatsu in construction equipment and Fanuc in machine tools.

Intel, meanwhile, is stepping up the competition. It boasts a high market share in central processing units for servers and personal computers, but its products are not as suited to the types of calculations needed for AI on their own. So the company is looking to absorb outside strength for AI chips through such steps as last year’s $15 billion purchase of Israel’s Mobileye, which specializes in technology for processing data from vehicle-mounted cameras. This May, Intel said it would launch a specialized chip for AI training in 2019.

Whoever wins out in the AI chip field will likely gain an overwhelming market share as Intel did with PC processors. Search giant Google has also begun supplying its own AI chips, and Chinese tech players like Alibaba Group Holding are developing them as well. As the “internet of things” brings connected devices into more and more fields, the battle to become the next top player in chips will likely intensify

Nikkei staff writers